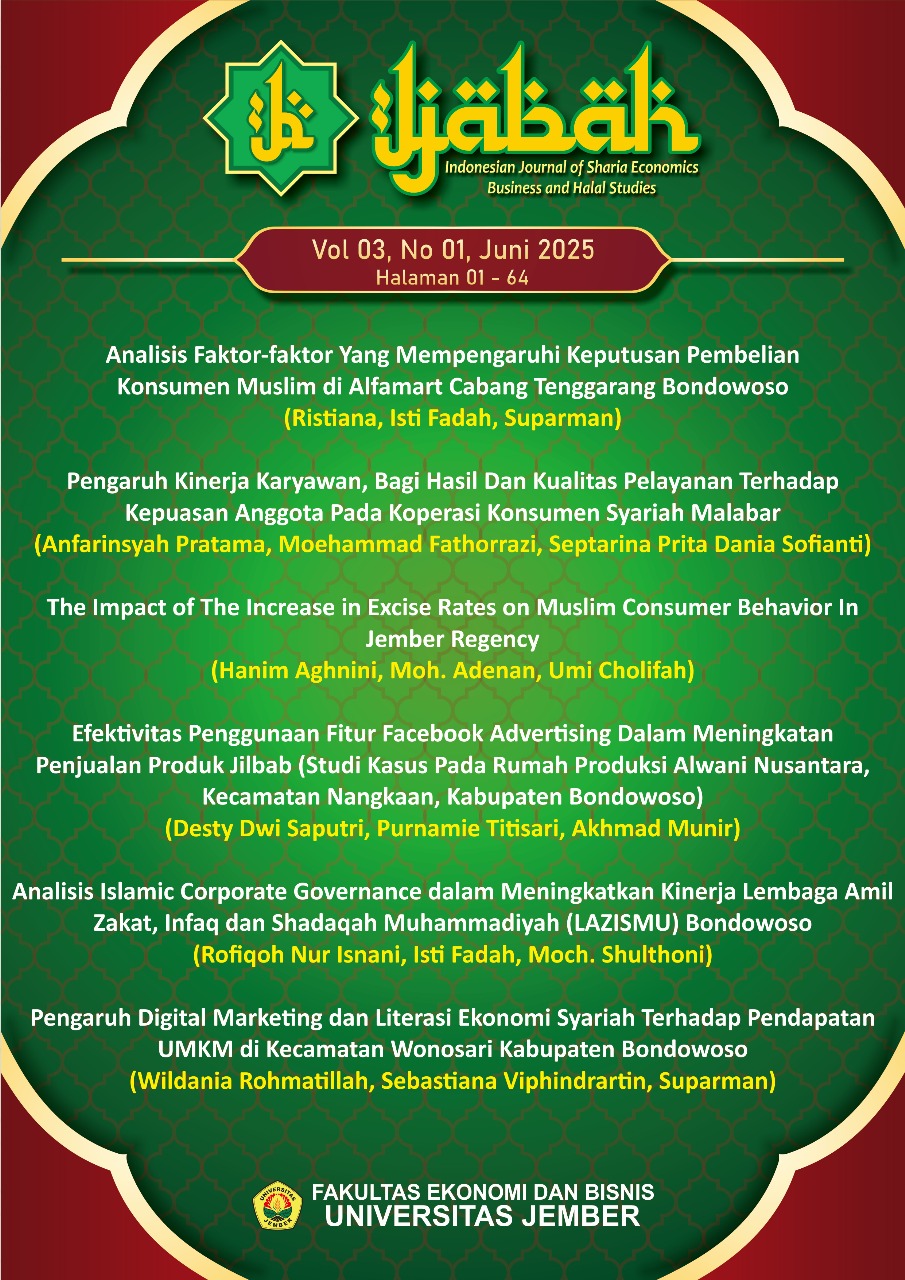

Pengaruh Peningkatan Tarif Pajak Konsumen terhadap Perilaku Konsumen Muslim di Kabupaten Jember

DOI:

https://doi.org/10.19184/ijabah.v3i1.1372Keywords:

Excise Rates, Consumer Behavior, Muslim.Abstract

The State Budget mechanism manages tobacco excise, which is state revenue, and has an important and strategic role in financing government programs and performance as well as development throughout the territory of the Republic of Indonesia in a planned, orderly, safe, fair, and sustainable manner. The government raises excise almost every year as part of their fiscal policy. The increase in excise rates has an impact on the economy, especially state revenue and tobacco production. This study will look at how the policy of increasing excise rates has an impact on state revenues and cigarette consumers because of its huge impact. A descriptive qualitative research method was used to explain the causal relationship between the increase in excise rates on state revenue and Muslim cigarette consumers in Jember district. The results of the study show that the policy of increasing excise rates for tobacco products implemented by the government increases excise revenue every year, despite the challenges faced by the government. However, the policy has a negative impact on the production of tobacco products due to the implementation of the policy. Therefore, the implementation of the excise rate increase policy will be contrary to the purpose of imposing excise rates, namely reducing the number of goods subject to excise and the amount received by the state.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 IJABAH

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.